Bridging the gap for retirement savers

A looming State Pension funding crisis underlines the need for retirement savers to make the most of available reliefs and allowances. Norfolk-based wealth management consultant Matthew Newton reports

Philip Hammond may have claimed in his Spring Statement that “there is light at the end of the tunnel” in rebuilding the UK’s finances, yet a paper published by the Government Actuary’s Department (GAD) has uncovered a potential hole in the public purse that could mean that the National Insurance Fund – from which State Pension payments are made – will run out in the early 2030s Philip Hammond may have claimed in his Spring Statement that “there is light at the end of the tunnel” in rebuilding the UK’s finances, yet a paper published by the Government Actuary’s Department (GAD) has uncovered a potential hole in the public purse that could mean that the National Insurance Fund – from which State Pension payments are made – will run out in the early 2030s

The report identifies a mismatch between the amount of money coming in through National Insurance contributions (NICs) and the amount going out in benefits – over 90% of which is absorbed by the State Pension

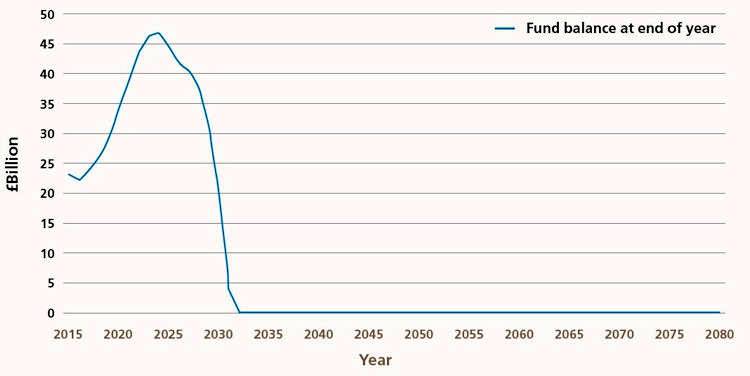

The balance of the fund currently stands at around £25 billion. Indeed, the short-term picture looks fairly healthy, as factors such as the rising State Pension age boost NIC receipts. However, the declining ratio of those in work to those in retirement, and the impact of the State Pension triple-lock – which guarantees that payments rise in line with the highest of average earnings, inflation or 2.5% – sees the size of the fund plummet from 2025 onwards. Under current assumptions, the fund will be exhausted from around 2032

“If the system is to continue to cover the current form of State Pension and other benefits, then either the fund’s income has to rise or expenditure has to be controlled,” says Martin Lunnon of GAD

The National Insurance fund

Source: Government Actuary’s Quinquennial Review of the National Insurance Fund as at April 2015, October 2017

To continue paying the State Pension in its current form, the government must find an extra £11.6 billion by 2030, rising to £55.9 billion by 2040. How it responds to ensure that additional funds are found in time is now the key question

In the wake of one of the longest and deepest financial squeezes in history, it’s hard to envisage cuts to key public services. Likewise, any further attempt to hike NICs is likely to spark the same firestorm that engulfed the Conservative Party a year ago, when it proposed changes for the self-employed. Indeed, “substantial increases in National Insurance contribution rates would both be particularly politically sensitive and would again require primary legislation,” notes GAD

Against that backdrop, the government could be forced to look elsewhere

It is already proceeding with an accelerated increase in the State Pension age: from 2020, it will be 66 for men and women, increasing to 67 between 2026 and 2028. Nevertheless, it’s quite possible that the State Pension age will have to rise further and/or faster than the current timetable

Furthermore, it seems unlikely that the State Pension triple lock can be maintained in its current form forever. However, scrapping it or downgrading it to a ‘double lock’ could prove hugely unpopular: the policy was toxic for the Conservatives during the 2017 election

Consequently, the government could be compelled to cut back on allowances and benefits provided to savers. Tax relief on pension contributions has been at the mercy of cash-strapped chancellors for some time, but whether this government has the appetite to abolish the higher and additional rates remains to be seen. Nevertheless, it spent more than £50 billion on tax relief last year1, prompting speculation that the system will be overhauled in the near future

It may well see more ‘salami slicing’ as the answer. The annual allowance for pension contributions came down from £255,000 a year, to £50,000 then £40,000. However, some top earners can see their annual allowance reduced to just £10,000 under new rules. It’s quite possible that those earning more modest sums could see a reduction applied to their allowance in future, making it much harder for them to build a sufficient retirement fund

Whatever happens, pension tax breaks for high earners are unlikely to become more attractive. It also seems inevitable that individuals will become increasingly responsible for funding their retirement as state benefits come under greater pressure

Those who can should try to take advantage of the generous reliefs and allowances while they are still available. This means making the most of each year’s annual allowance and carrying forward any unused allowances from the three previous tax years. That way, individuals can benefit from current rates of tax relief and potentially enjoy a higher income when they stop work

The levels and bases of taxation, and reliefs from taxation, can change at any time and are dependent on individual circumstances

1 HMRC, Personal Pensions Statistics, February 2018

To receive a complimentary guide covering wealth management, retirement planning or inheritance tax planning or for further details contact Matthew Newton, Tel: 01603 755027 To receive a complimentary guide covering wealth management, retirement planning or inheritance tax planning or for further details contact Matthew Newton, Tel: 01603 755027

Email: matthew.newton@sjpp.co.uk

Website: www.matthewnewtonwealthmanagement.co.uk

Click here to read more about Matthew's services on this website

This column contains sponsored content and the views carried here are those of the author, not of Network Yarmouth

First published on Network Norfolk and reproduced with permission

|